Introduction: Why Culture Determines the Exit, Not Just Capital

Startup founders often focus obsessively on funding rounds, product-market fit, and growth metrics. But when it comes time to exit—whether through acquisition, merger, or IPO—most deals don’t fall apart due to lack of capital. They fail because of culture, governance gaps, or leadership misalignment.

As someone who’s worked with founders and investors across Southeast Asia and beyond, I’ve seen it repeatedly: a promising startup reaches the negotiation table only to realize that it’s structurally or culturally unprepared for life after the exit. And this isn’t just about paperwork or compliance. It’s about whether your startup thinks and behaves like a board-ready organization from Day 1.

This article explores how startup leaders can build board-aware cultures that attract acquirers, increase valuation, and create legacy-ready ventures—not just products with potential.

Chapter 1: Why Exits Fail — It’s Not the Capital, It’s the Culture

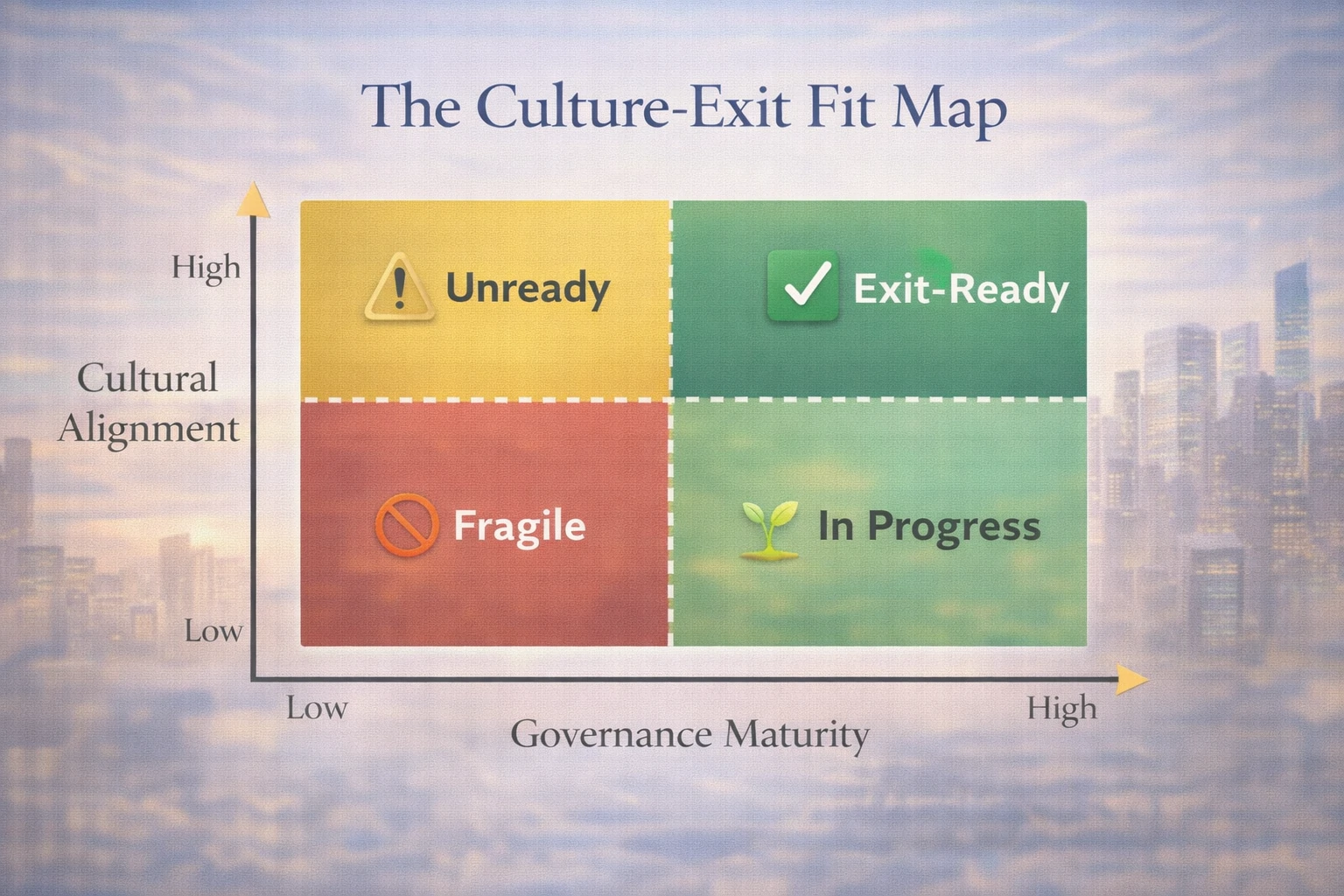

When a startup fails to close a successful exit, the headline narrative usually blames external conditions: market timing, investor appetite, or shifting valuations. But if you speak privately with seasoned acquirers or late-stage VCs, they often point to something more foundational: internal culture misalignment and a lack of governance maturity.

This isn’t just a theory. Let’s look at why culture, not capital, kills more exit dreams than most founders realize.

- The “Founder Dependency” Trap

Many early-stage companies are built around a charismatic founder who wears every hat. While this hustle is necessary in the beginning, it becomes a liability during acquisition talks. Acquirers don’t just buy products; they buy systems, people, and predictability. If everything hinges on the founder, the company becomes a risk, not an asset.

Thai Case Example: A promising Thai healthtech startup was in talks with a Singapore-based acquirer. The product was innovative and had strong user growth. But the founder was the sole decision-maker, lead sales closer, and product visionary. There was no second layer of leadership. The deal stalled, not due to valuation disagreement, but because the acquirer couldn’t see continuity without the founder.

Lesson: Build succession into your culture early. Groom second-line leaders. Document decisions. Empower others.

- Governance Blind Spots

Startups often treat governance as a post-Series B issue. That’s a mistake. Without basic governance mechanisms—like board minutes, cap table hygiene, structured reporting, and founder agreements—your exit can collapse under due diligence.

International Case Example: A European startup with $10M ARR was days away from closing a strategic acquisition. During due diligence, the acquiring company found inconsistencies in shareholder agreements and unclear IP ownership. These weren’t malicious errors—just governance immaturity. The acquirer walked away.

Lesson: Even if your board is informal, your documentation shouldn’t be. Treat governance as culture, not just compliance.

- Misaligned Cultural Expectations

This is especially relevant in cross-border M&A—common in Southeast Asia. A startup rooted in Thai values like Kreng Jai (deference to hierarchy) may be acquired by a Western firm that values direct feedback and speed. If the startup’s team can’t adapt or if cultural clashes are ignored, integration will fail.

Insight: Acquirers often spend months post-deal managing cultural fallout. Smart ones now assess cultural fit before signing.

Lesson: Embed cross-cultural literacy in your team early. Train leaders to operate in multiple business dialects.

- The Overhyped Narrative Problem

Many startups inflate their metrics or lean too hard into “hype” branding. This works to attract early-stage attention but backfires during exit. Sophisticated buyers want to see consistent performance, real user engagement, and long-term viability.

Reality: Acquirers often discover the metrics aren’t repeatable or sustainable. Trust erodes. Deals fall apart.

Lesson: Build a culture of truth. Teach your team to tell clear, honest stories backed by data.

- Emotional Unreadiness of Founders

Even when the numbers line up, deals collapse because founders aren’t emotionally ready to exit. They sabotage negotiations, delay key decisions, or resist transitioning power. This is rarely discussed openly, but it’s a major reason exits fall apart.

Tip: Emotional intelligence is a board-level skill. Work with advisors or executive coaches to prepare psychologically for the exit long before it happens.

In Summary:

Founders often think exits are financial events. In reality, they are organizational maturity tests. Your culture, structure, and leadership readiness are what make you exit-worthy.

If your startup wants to be seen as a high-value acquisition target, don’t just scale users or revenue. Scale board readiness:

- Build decision-making frameworks

- Document your internal logic

- Train for cultural agility

- Think in systems, not just stories

Because when the exit moment comes, capital might open the door. But only culture will get you through it.

Chapter 2: The Role of Governance From Day One

For many early-stage founders, the term “governance” sounds bureaucratic—a buzzword reserved for corporates or post-Series C startups. But in reality, governance is not about slowing down innovation. It’s about creating the clarity, accountability, and decision-making hygiene that allow innovation to scale.

Good governance doesn’t start at the IPO stage. It starts the moment a startup decides to be serious about its future.

Governance Isn’t a Boardroom – It’s a Mindset

Governance is not about forming a board with suits and checklists. It’s about embedding the principles of:

- Transparency

- Accountability

- Ethical decision-making

- Strategic foresight

…into your daily operating culture.

When founders think of governance as a mindset rather than a structure, it becomes a tool for founder protection and value creation, not red tape.

- Founder Agreements and Equity Hygiene

One of the most common startup pitfalls? Ambiguous or poorly documented founder agreements.

What happens if a co-founder leaves? Do they walk away with equity? Are there vesting conditions? Have you aligned on vision and responsibilities?

Key Tip: Use a Founders’ Agreement early on. Clarify roles, responsibilities, equity, and what happens in worst-case scenarios. Add cliff and vesting schedules.

Not only does this protect your startup’s cap table—it shows acquirers and investors that your company understands founder continuity and conflict management.

- Forming an Advisory or Light Board Early

Even before you raise institutional capital, begin forming a light board or advisory council. This isn’t about adding layers of authority—it’s about practicing how to share updates, seek strategic feedback, and build a decision culture.

Your early advisors should:

- Challenge your thinking

- Help you model governance behavior

- Support early investor relations

Thai Example: A Chiang Mai-based agritech startup brought in a seasoned FMCG executive as a board advisor early. His presence gave credibility with food exporters and helped shape the company’s procurement strategy—well before they needed formal governance.

- Build Meeting and Reporting Hygiene

Acquirers and investors look for consistency in reporting. Build the habit of documenting:

- Monthly operating updates

- Key hiring decisions

- Budget allocations and spend tracking

- Founder meeting minutes

Even a basic Google Doc with consistent formatting signals discipline.

Why it matters: When due diligence begins, your operational history becomes a trust signal. If everything lives in your head or scattered emails, your credibility erodes quickly.

- Clarify Decision-Making Frameworks

A board-ready culture means your team understands how decisions are made and who makes them.

Too many startups default to:

- Consensus for everything (slow and unclear)

- Founder fiat (fast but risky)

Instead, use models like:

-

- RACI matrices (Responsible, Accountable, Consulted, Informed)

- One-way vs. two-way door decisions

- Decision logs (What was decided, by whom, and why)

These frameworks make your startup look and feel like an institution—even if it’s still a team of 10.

- Introduce Governance Without Killing Speed

Governance often gets a bad name because it’s seen as anti-agility. But when done well, it creates faster paths to decision-making.

How?

- It reduces debates by clarifying roles.

- It makes founders more fundable by showing maturity.

- It reduces founder fatigue by spreading accountability.

Governance is not a brake. It’s a steering wheel.

- Align Values Early

One of the most overlooked aspects of governance is values alignment.

Build early agreements on:

- What kind of business you are trying to build

- What kind of deals you won’t accept

- How you treat people, customers, and investors

These value frameworks act as internal governance—a compass when legal structures aren’t enough.

Case Insight: A regional edtech company rejected a lucrative acquisition because the buyer’s employee policies clashed with their team-first culture. That clarity came from early value articulation—a form of cultural governance.

In Summary:

If you want to prepare your startup for a smooth, high-value exit, governance is not optional. It must be part of your DNA from day one.

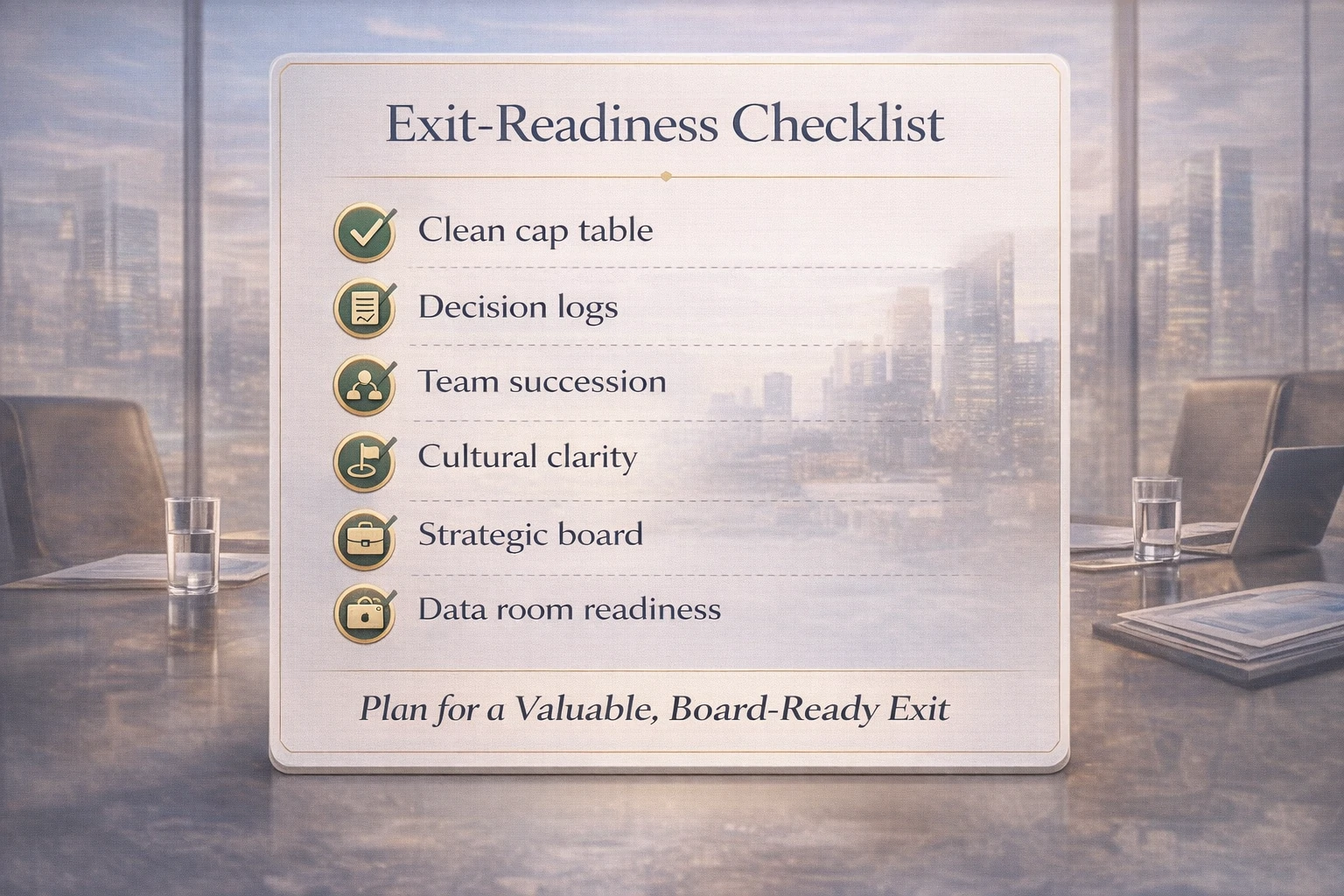

Start simple:

- Founder agreement

- Light advisory board

- Clear reporting cadence

- Decision frameworks

- Cultural values

These small steps compound into a reputation for maturity, readiness, and trust.

And when the acquirers come, they won’t just see a startup. They’ll see a future-proof organization.

Chapter 3: How to Prepare for M&A with the Right Board

When acquisition conversations begin, most founders instinctively turn to lawyers and investment bankers. But long before any term sheet is drafted, the right board composition is often what sets the stage for a smooth, strategic exit.

Why? Because a board is more than a formality. It’s a signal of operational maturity, strategic foresight, and negotiation strength.

Let’s unpack how to build a board that doesn’t just advise—but actively shapes your M&A readiness.

- Start With Strategic Board Composition

A truly M&A-ready board isn’t just filled with investors. It’s curated with:

- Legal expertise: to review contracts, IP, and regulatory risk

- Finance acumen: to guide valuations, term negotiations, and investor dynamics

- Industry insiders: who bring acquisition insights and relationships

- Founder empathy: individuals who have navigated exits before

Avoid stacking your board with only VCs or passive advisors. Instead, think like a buyer: Who would a potential acquirer trust to represent this company’s interests clearly and professionally?

Tip: If you plan to exit to a corporate, consider having a retired C-level executive from a similar sector on your board. Their lens is invaluable.

- Educate the Founder-Board Relationship Early

Many founders treat the board as a formality—until it’s too late. To leverage the board in exit conversations, the relationship must be strong, strategic, and transparent.

This means:

- Sharing both wins and risks during board meetings

- Asking for feedback, not just approval

- Involving the board in scenario planning for exits

- Building mutual trust that extends beyond investor rights

Key Insight: Acquirers often assess how well-aligned and functional your board is. A dysfunctional board equals post-deal risk.

- Set Up M&A Scenario Reviews

Even if an exit feels far away, simulate exit discussions during board meetings once a year.

Example prompts:

- “If a strategic buyer offered 3x our current revenue today, what would we do?”

- “Which acquirers would value our IP vs. our user base?”

- “What gaps would we need to close to become acquisition-ready?”

These conversations shape both founder and board expectations. They also reveal blind spots long before real negotiations begin.

- Maintain a Clean Data Room — Always

When an acquisition opportunity arises, due diligence moves fast. Your board should ensure that critical documents are:

- Updated

- Organized

- Secure

Maintain a “living” data room with:

- Cap table and shareholder agreements

- Financials and forecasts

- Customer contracts and IP licenses

- Employee stock option plan details

- Compliance and regulatory records

Tip: Let your board periodically review your data room. This builds readiness discipline.

- Practice Board-Level Communication

M&A readiness also means learning how to speak the boardroom language.

Founders who talk in product features or passion stories often struggle during acquisitions. You need to show:

- Strategic logic

- Financial modeling

- Market positioning

- Risk mitigation

Use board meetings to practice elevating your communication. Over time, this shapes your narrative for future acquirers.

- Build Optionality Into Your Board Strategy

Some boards are built to go public. Others to exit via acquisition. Some aim for family succession. Your board strategy should reflect your exit optionality.

If you’re unsure about your future path, consider board members who:

- Understand both capital markets and M&A

- Are founder-first, not just investor-aligned

- Can adapt their advice based on shifting conditions

Pro Tip: Avoid creating a board that’s over-optimized for one path. Keep strategic options open.

- Tap Your Board’s Networks

Well-composed boards are deal flow machines.

They:

- Introduce strategic buyers

- Warm up relationships with future partners

- Vouch for you during diligence calls

- Provide backchannel references on potential acquirers

Thai Example: A Bangkok-based logistics startup had a former Amazon VP on its board. When the startup sought cross-border expansion, the board member facilitated a connection with a regional logistics acquirer. That intro turned into a term sheet.

- Design an Exit Committee

As your startup matures, consider forming a sub-committee focused on strategic exit planning. This group can:

- Evaluate offers

- Stress-test valuation logic

- Coordinate with legal and finance

- Align stakeholders around timing and structure

Even informal versions of this committee increase your ability to move quickly when opportunity knocks.

In Summary:

Your board isn’t just for governance. It’s an exit strategy asset.

A startup with the right board:

- Attracts higher-quality acquirers

- Closes deals faster

- Avoids governance red flags

- Protects founder and investor value

Start building that board now. Don’t wait for a Series C or a suitor to appear.

Because the best exits aren’t created in negotiations. They’re orchestrated through years of board-level readiness.

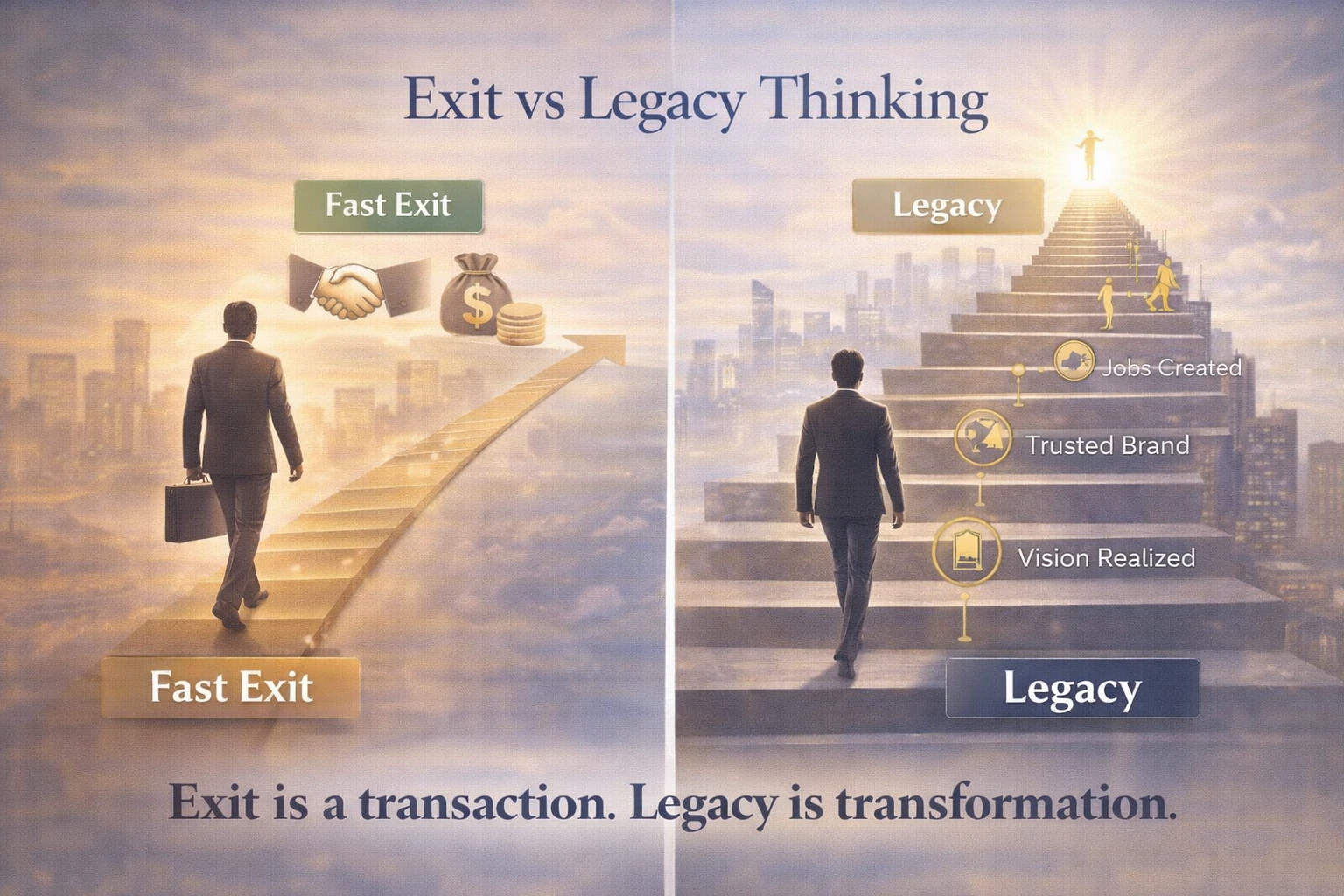

Chapter 4: Exit vs. Legacy Thinking for Entrepreneurs

For many founders, the idea of an exit is synonymous with success. It signals validation, wealth, and a job well done. But an exit is not the finish line. It’s a fork in the road: Will this startup become a one-time success or the foundation of a lasting legacy?

This chapter explores the mindset shift from transactional exit thinking to long-term legacy building—and why it matters more than ever for entrepreneurs in Asia.

- The Myth of the Perfect Exit

We’ve glamorized exits in startup culture: the big headline acquisition, the IPO bell, the “founder made it” moment. But the truth? Many exits are:

- Underpriced due to urgency or fatigue

- Misaligned with company values

- Poorly integrated post-acquisition

- Emotionally disorienting for founders

What looks like a win on TechCrunch might feel like a regret 6 months later.

Lesson: Not all exits are created equal. A great exit aligns timing, values, price, and purpose.

- The Danger of Exit-Only Thinking

When founders obsess over exits too early, it can distort decision-making:

- Hiring decisions become short-term (cheap and fast, not strategic)

- Brand-building gets deprioritized in favor of quick growth hacks

- Culture suffers as urgency overtakes clarity

Investor Insight: Experienced VCs often caution against founders who talk about exits too early. They want builders, not flippers.

Tip: Focus on building a company that people want to buy—not just a company you’re desperate to sell.

- The Legacy Lens: 3 Questions Founders Should Ask

Instead of asking, “When can I exit?” try asking:

- What will this company stand for five years after I leave?

- Would I be proud to see this brand in someone else’s hands?

- What kind of story will my exit tell—to my team, my market, my future self?

This mindset doesn’t delay your exit—it sharpens your value proposition.

- Designing Exit-Resilient Culture

Legacy thinking isn’t just a philosophy. It’s a design principle.

How to build it:

- Values-based hiring: Prioritize character and alignment over just skills

- Founder transparency: Talk openly with your team about long-term visions

- Mission clarity: Ensure everyone knows the “why” behind the work

- Customer-first obsession: Make customers advocates, not just users

Startups that design this way attract better acquirers and sustain growth post-exit.

- Personal Legacy as a Founder

Beyond your company’s fate, think about your own brand.

Ask:

- Do people see you as a builder, mentor, advisor, or operator?

- Are you shaping the ecosystem or just optimizing your own path?

- What kind of founders or investors will you attract in your next chapter?

Founder Case: A well-known Thai fintech founder exited his company at a healthy valuation but stayed to mentor young founders and became a board advisor. His post-exit brand amplified because of how he handled the transition.

- Exit and Legacy Aren’t Opposites

You don’t have to choose between exit and legacy. The best founders engineer both:

-

- They build institutions, not just apps

- They view exits as transfers of stewardship, not just transactions

- They stay involved in shaping outcomes post-deal

Case Insight: Consider Patagonia. The founder exited but engineered a legacy by redirecting profits toward environmental causes. That was exit strategy + legacy strategy in one.

- Southeast Asia Needs Legacy-Minded Builders

As the ASEAN ecosystem matures, we need more founders who:

- Build responsibly

- Exit intentionally

- Reinvest in ecosystems

- Leave playbooks behind

The next wave of founders will stand on the shoulders of today’s legacy thinkers.

Let that be you.

In Summary:

Exits are not just financial events. They are public expressions of your private values.

Build your startup so that you can exit with pride. But more importantly, build so your story lives on.

Because in the end, it’s not the valuation that defines your legacy. It’s how you led, what you left behind, and who you became along the way.

Chapter 5: Lessons From Thai and Global Startup Exits

Real-world exits provide the most honest education for founders preparing their own. This chapter draws lessons from both Thai and global startup stories—some that soared, others that stalled.

- Flash Express: Momentum Meets Ecosystem Leverage

Flash Express became Thailand’s first unicorn through smart infrastructure investment and aggressive market capture. But what set it apart wasn’t just scale—it was strategic alignment with ecosystem enablers like government logistics initiatives and cross-border support.

Lesson: Build with ecosystem leverage in mind. Future acquirers look at your strategic allies as much as your numbers.

- Wongnai x LINE MAN Merger: Cultural Compatibility Wins

The merger between Wongnai and LINE MAN created one of Thailand’s most successful tech consolidations. Behind the scenes, what made it work was a cultural compatibility between teams and leadership values.

Insight: Even great synergy on paper can fail without cultural respect. Prepare your team for integration, not just transaction.

- Grab x Uber SEA: Speed, Scale, and Timing

Grab’s acquisition of Uber SEA operations was a masterclass in speed, ecosystem knowledge, and capital deployment. The deal wasn’t just opportunistic; Grab had been building governance, cross-border systems, and local partnerships long before.

Lesson: Be ready before the opportunity arrives. The best exits are prepared, not improvised.

- Failed Acquisition: A Thai Healthtech Stumble

A Thai healthtech startup with a promising AI-based diagnostic product attracted a major Singaporean healthcare group’s attention. But due diligence uncovered vague IP ownership, poor data handling policies, and over-dependence on the founder. The deal collapsed.

Lesson: Even brilliant products can be deal-killers if governance is weak.

- Bukalapak IPO: Exit Isn’t the End

Indonesia’s Bukalapak went public in a landmark IPO. But what surprised many was the founder’s low-key role post-listing and the stock’s volatile performance. The takeaway? Going public doesn’t equal long-term success without operational discipline.

Lesson: Treat exit as a milestone, not a destination.

- The Unseen Wins: Silent Acquihires

Many Thai and SEA startups never announce their exits—they’re quietly acquihired by regional or global players. In these cases, founders may secure team continuity or IP protection, but not headline valuations.

Insight: Not all exits need to be loud. Define your success metrics early.

- The Second-Time Founder Advantage

Founders who exit well tend to attract better talent, funding, and opportunities for their next ventures.

Case: A Thai SaaS founder exited his B2B startup modestly but used that experience to launch a new product, this time with stronger governance, clearer equity splits, and board advisors from day one.

Lesson: Exits compound your reputation. Protect your name more than your valuation.

- The Missed Moment: Valuation Over Reality

A Southeast Asian edtech startup turned down an acquisition offer that would have secured team longevity and regional scale, hoping for a better Series C. The funding market dried up. They later sold at a loss.

Lesson: Timing is everything. Exit when you’re strong—not when you’re forced.

In Summary:

- Learn from exits around you—both celebrated and silent

- Focus on readiness: cultural, operational, strategic

- A board-ready startup is an acquirer’s dream

- Legacy is shaped in the exit—not just in the build-up

Study these lessons. Let them shape your leadership.

Because the real exit strategy? Is becoming a founder others want to build with, acquire from, and learn from—again and again.

#StartupExitStrategy #BoardCulture #StartupGovernance #AndeAditya #MAReadiness